Getting The The Maplewood Rochester Ny Nursing Homes To Work

Wiki Article

The Ultimate Guide To The Maplewood Nursing Home Rochester Ny

Table of Contents9 Easy Facts About The Maplewood Rochester Ny Nursing Homes ShownThe The Maplewood Nursing Home In Rochester Ny PDFs6 Simple Techniques For The Maplewood Nursing Home Rochester NyHow The Maplewood Rochester Nursing Home can Save You Time, Stress, and Money.The Buzz on The Maplewood Nursing Homes Rochester

Lasting treatment expenses vary from one location to one more. The expense for lasting care services will raise over time.A business needs to offer you at the very least 45 days' notification of a price rise. A company can not increase your prices because your wellness becomes worse or you have claims. A business needs to renew your plan each year if you want it to. It can reject to restore your plan if: It discovers you existed about your wellness when you got the plan.

You used all your benefits. You can cancel your policy at any moment. If you do, the firm must return any type of unearned costs to you. Unearned costs is cash you paid that really did not approach protection. If you paid 6 months of premium in advance but canceled the plan after 2 months, the company should refund 4 months of premium to you.

After you've had your plan for two years, a firm can not terminate it or decline to pay insurance claims because you gave incorrect information on your application, unless the incorrect details is illegal. A company can not cancel your plan for nonpayment of premium unless you have not paid the premium for a minimum of 65 days past the due day.

Not known Incorrect Statements About The Maplewood Nursing Homes Rochester Ny

If the company cancels your plan for nonpayment, it needs to restore the policy if you send proof that you really did not pay costs due to a psychological or physical impairment. You normally have concerning five months to do this. The business has to also pay any kind of cases for protected services. You'll need to pay costs back to the day the policy expired.The six ADLs are bathing, consuming, clothing, utilizing the restroom, continence, and also moving from location to place - The Maplewood nursing home rochester. You could additionally get advantages if you have a clinical requirement or special needs. Tax-qualified plans require that you have a cognitive disability, such as Alzheimer's, or be incapable to do 2 of the six ADLs for a minimum of 90 days.

Other policies base the elimination duration on schedule days. Some plans have only one elimination duration.

The Definitive Guide for The Maplewood Nursing Home Rochester Ny

Prior to getting a plan, understand how the elimination duration works. An advantage period is the length of time a policy will certainly pay advantages - The Maplewood nursing home rochester ny.If you don't utilize all your $100 a day benefit, your policy might last much longer than 2 years. You can normally select the benefit amounts you want. To assist you determine on your advantage amounts, check prices for nursing houses, assisted living facilities, as well as house healthcare agencies in the location you'll live when you need care.

It might be years prior to you require long-lasting treatment solutions. Long-lasting treatment expenses will possibly go up in that time.

The firm should offer you a contrast of plan benefits with and without rising cost of living protection over a 20-year duration. If you don't desire inflation defense, you must deny it in writing. Firms have to guarantee that you'll get several of the benefits you spent for, even if you cancel your policy or shed protection.

The Ultimate Guide To The Maplewood Nursing Home In Rochester Ny

You might be able to stop paying costs blog while you're in a nursing residence, however not while getting adult day care solutions. The business will certainly refund some or all your premiums minus any kind of insurance claims paid if you terminate your policy. Your beneficiary will obtain the refund if you die.

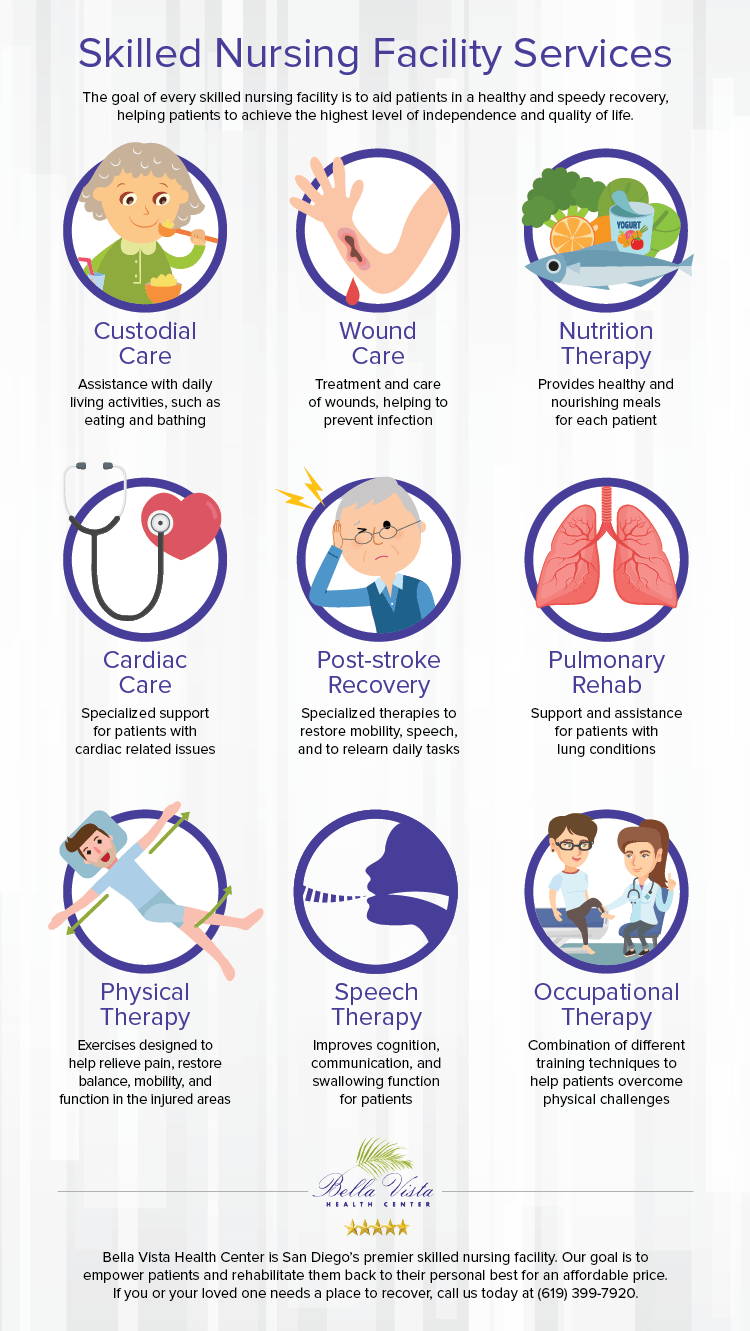

Ask on your own these concerns regarding the plans you're considering acquiring: Policies can offer a great deal of solutions, including residence healthcare, adult daycare, assisted living center care, and also retirement home care. They have to cover all levels of treatment from custodial to intermediate to proficient treatment. Policies won't pay till you have actually met needs, such as being not able to execute activities of day-to-day living or coming to be cognitively impaired.

Some Known Details About The Maplewood Nursing Home In Rochester Ny

All business must supply rising cost of living defense. If you don't desire it, you should decline it in creating. The firm might have various other alternatives for rising cost of living defense. Keep in mind that to be planned for rising cost of living, you must pay a higher premium today or higher out-of-pocket prices later on. Business should use you a warranty that you'll obtain several of the advantages you spent for also if you terminate or shed coverage.If you get a tax-qualified policy, you may be able to subtract part of the costs you paid as a clinical cost on your earnings taxes. Advantages paid from a tax-qualified plan are typically not gross income. The policy has to state whether it's tax-qualified or non-tax-qualified. Some business let you transform or increase your insurance coverages or advantage amounts after you acquire a policy.

Report this wiki page